Senti-Wave timing for ETF's-Stocks-VIX

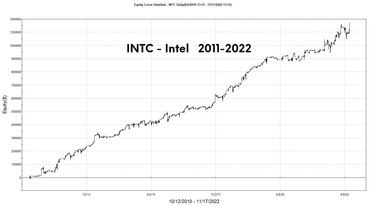

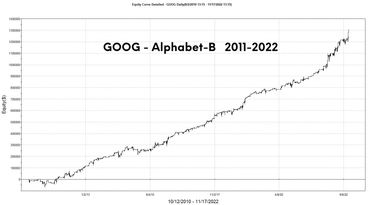

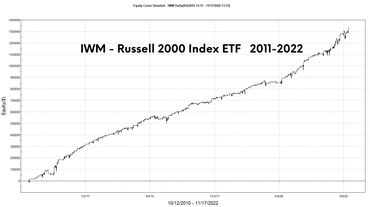

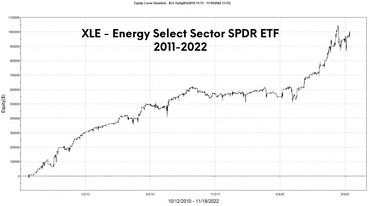

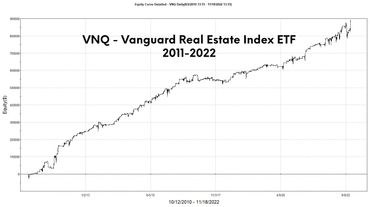

The following charts are examples of the Senti-Wave timing signals applied to ETF's, stocks and the VIX Index (VX Futures can be traded).

DON'T BUY OR SELL WITHOUT IT AND REMEMBER...

TRADE WITH CONFIDENCE !

NASDAQ 100, VIX and META(a distressed stock)

NASDAQ 100 INDEX WITH SENTI-WAVE TIMING STRATEGY

Trading the NDX 100, the average return is 15% a year, 82% winning trades, 40 trades a year, average 11 days in trade, 60% of the time in cash, only 5% of the time fully invested, maximum 10% drawdown on this backtest example. The strategy can also generate short trades (not shown in this example) a Tradestation performance statistic summary page is available on request.

VIX INDEX USING SENTI-WAVE TIMING

The strategy is capitalizes on waves of over-sold and over-bought environments in the equity markets and in the volatility of those markets. The strategy times the VIX Index, trades VIX index futures (VX) and takes advantage of directional momentum and volatility reacting as a market sentiment barometer. It is designed to achieve steady and consistently positive returns in all market environments. Apply Senti-Wave for a 'method to the madness' of the VIX.

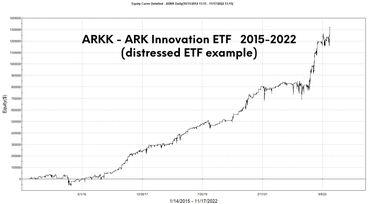

SENTI-WAVE FOR DISTRESSED STOCK AND ETF TRADING

The Senti-Wave strategy can be a true equity saver for stocks and ETF's that have had recent fundamental changes and have fallen 'out of favor' with investors. Senti-Wave timing can reduce or in some cases even eliminate equity drawdowns as shown in this example of META/Facebook. Often extra high volatility will create an opportunity for increased profits while the market adjusts to recent changes in the stock's forward EPS adjustments.

Senti-Wave Timing on ETF's

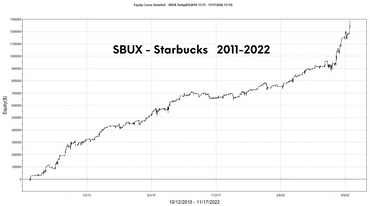

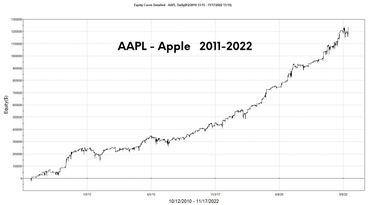

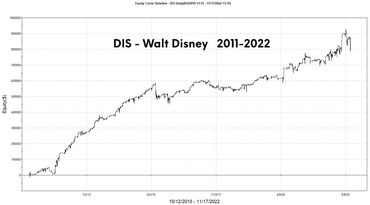

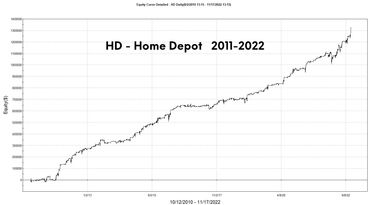

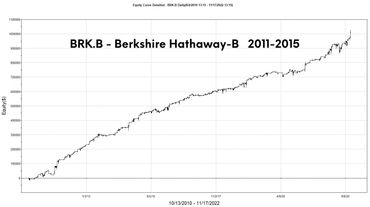

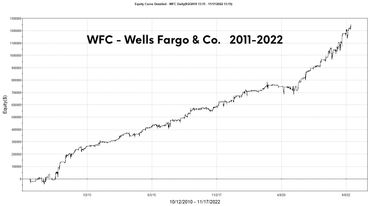

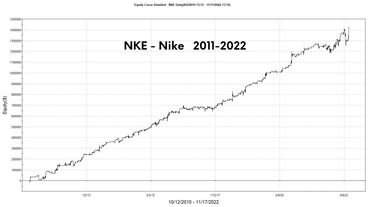

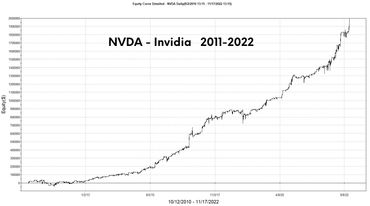

Senti-Wave Timing On Stocks